Student Loans Explained: Types, Rates, and How to Apply (2025 Guide)

College tuition keeps rising, and for many students, student loans are the only way to afford a degree. But before you borrow, it’s important to understand exactly how student loans work — including the different types, interest rates, repayment options, and how to apply the smart way.

This 2025 student loan guide breaks down everything you need to know in simple, student-friendly terms so you can borrow only what you need, and pay it back wisely.

🎓 What Are Student Loans?

A student loan is money you borrow to help pay for college expenses like:

- Tuition and fees

- Textbooks

- Housing and meals

- Supplies and transportation

You must pay it back, usually with interest, after you graduate (or stop attending school).

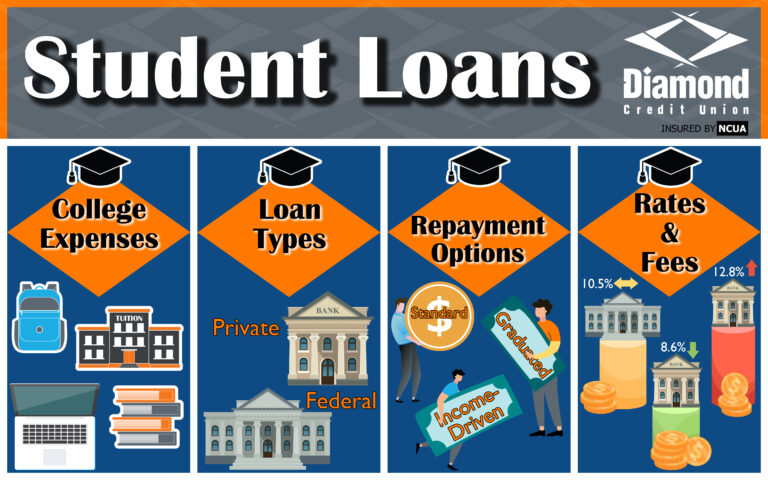

✅ Types of Student Loans

There are two main types: federal loans (from the government) and private loans (from banks or online lenders).

1. Federal Student Loans (Best for Most Students)

Offered by the U.S. Department of Education, federal loans have:

- ✅ Lower fixed interest rates

- ✅ Income-based repayment options

- ✅ Loan forgiveness programs

- ✅ No credit check required (in most cases)

Main Types of Federal Loans:

| Loan Type | Who It’s For | Interest Rate (2025 est.) | Borrowing Limit |

|---|---|---|---|

| Direct Subsidized | Undergrads with financial need | ~5.50% | $3,500–$5,500/year |

| Direct Unsubsidized | All students | ~5.50% | Up to $20,500/year |

| Direct PLUS | Parents or grad students | ~8.05% | Cost of attendance |

Subsidized = Interest-free while in school

Unsubsidized = Interest starts right away

2. Private Student Loans (Use Only If Needed)

These are loans from banks, credit unions, or online lenders.

- 🔐 Credit check required (may need a co-signer)

- 🔁 Variable or fixed interest rates

- ⛔ No federal protections or forgiveness options

Use private loans only after maxing out federal aid.

Top lenders in 2025:

- Sallie Mae

- SoFi

- College Ave

- Discover Student Loans

💰 How Interest Works on Student Loans

Interest is the extra cost you pay to borrow money. It’s either:

- Fixed: Stays the same over the life of the loan

- Variable: Can change with the market (riskier)

Example:

Borrow $5,000 at 5.5% interest → Pay ~$275 extra per year in interest alone.

Tip: Subsidized loans don’t charge interest while you’re in school full-time.

📋 How to Apply for Student Loans (Step-by-Step)

📝 For Federal Loans:

- Fill out the FAFSA (Free Application for Federal Student Aid)

→ https://studentaid.gov - Get your Student Aid Report (SAR)

- Review your award letter from your college

- Accept the loan offer online

- Complete loan entrance counseling and sign a Master Promissory Note (MPN)

📅 Tip: Complete FAFSA as early as October 1st for the best aid offers.

🏦 For Private Loans:

- Research and compare lenders (use student loan comparison tools)

- Choose a lender and apply online

- Submit required documents (ID, school info, income, co-signer info)

- Wait for approval (can take 1–5 business days)

- The lender sends funds directly to your school

📈 How Repayment Works

🕒 When do I start paying?

- Federal loans: 6-month grace period after graduation

- Private loans: May vary — some require payments while in school

💳 Federal Repayment Options:

| Plan | Monthly Payment | Based On |

|---|---|---|

| Standard | Fixed over 10 years | Loan amount |

| Income-Driven | 10–20% of your income | Your earnings |

| Extended | Up to 25 years | Total debt |

| Graduated | Increases every 2 years | Loan age |

🎁 Loan Forgiveness & Cancellation (Federal Only)

You may qualify for loan forgiveness if:

- You work in public service or teaching (PSLF Program)

- You’re on an income-driven plan for 20–25 years

- Your school closes or misleads you

💡 Private loans do not offer forgiveness.

❓ FAQ: Student Loans in 2025

Q: Should I borrow the full amount I’m offered?

No — only borrow what you truly need. More debt = more to repay later.

Q: Can I get student loans without a co-signer?

Yes. Federal loans don’t require a co-signer. Some private lenders do, especially if you have no credit or income.

Q: Are student loans worth it?

If your degree leads to better income and you borrow responsibly — yes.

Just avoid unnecessary loans and always understand the repayment terms.

🏁 Final Thoughts: Borrow Smart, Graduate Debt-Savvy

Student loans are a helpful tool — but they’re not free money. Use them to invest in your future, not to fund a lifestyle. Prioritize federal loans first, keep your total debt low, and understand your repayment options before signing.

👉 Need more help financing school?

Read next: How to Make Money Online as a Student in 2025